As we ring in the new year, the world of financial services buzzes with a pivotal question: Will Generative AI (Gen AI) live up to the hype and start showing material and quantifiable business benefits? Only time will tell, but if we dig into Celent’s recently published report “Gen AI: Lens on Use Cases- Tech Provider Survey,” it’s clear technology providers are sanguine about Gen AI’s prospects to make an indelible mark. Here are some takeaways:

Vendors Indicate Clear Optimism Towards Gen AI:

According to Celent’s survey, a whopping 87% of vendors are “Excited by the potential impact of Gen AI on the FS Industry,” and 84% believe that the benefits from investing in Gen AI will lead to a “sustainable competitive advantage.” Given the application of Gen AI is quickly coming to table stakes, it is interesting that many of our participants see its use as providing them a sustainable competitive advantage. In 2024, it will be instructive to see how sustainable the competitive advantage will be.

Follow the Money:

According to the survey, most firms are allocating the highest level of resources toward areas focused on operational efficiency, indicating the belief that Gen AI will optimize existing processes. Of the 13 categories presented, a leading 80% of respondents noted they were devoting High or Moderate resources to claims tech development. Expect 2024 to bestow carriers with many claims-focused Gen AI uses.

Another area where vendors added many resources was in “Code Development,” with 49% of vendors investing High resources and 29% investing Moderate resources. The implication is there is a great deal of optimism towards Gen AI in automating code generation and enhancing development processes. We believe this is an underrated yet highly impactful use case that will come to fruition in 2024. Moreover, vendors appear to see a great deal of promise in many use cases, with 30% of respondents noting they are devoting High relative resources to at least 6 of the 13 areas provided.

“Show Me The Use Cases!”

As Jerry Maguire famously said, “Show me the money!” In the context of financial services in 2024, this iconic line could be adapted to “Show me the use cases!” when it comes to Generative AI (Gen AI). The industry is ripe with anticipation as we venture into the new year, pondering whether Gen AI will deliver on its promises of tangible and quantifiable business benefits.

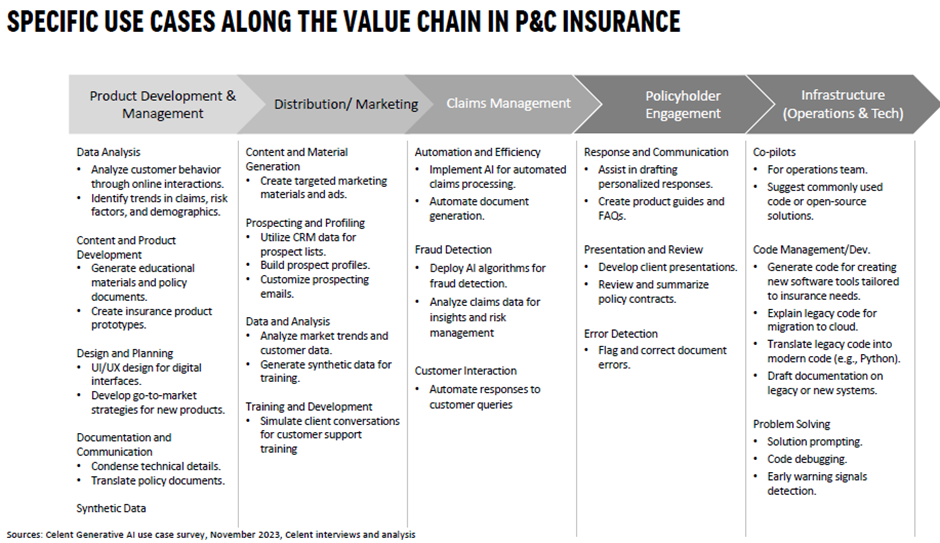

Delving into specific use cases of Gen AI along the P&C insurance, here are some highlights:

1. Data Synthesis and Analysis: Gen AI is expected to play a crucial role in synthesizing and analyzing vast amounts of data, facilitating more informed decision-making and efficient processing.

2. Customer Service Co-Pilots: These AI-driven assistants could revolutionize customer interactions, offering personalized and efficient service.

3. Claims Processing: As noted in the survey, Gen AI is poised to transform claims processing,

4. Risk Management and Compliance: Leveraging Gen AI for risk assessment and regulatory compliance could significantly improve accuracy and reduce manual effort.

5. Personalized Product Recommendations: Tailoring insurance products to individual customer needs and preferences could be significantly enhanced by Gen AI’s capabilities.

The Year Ahead:

2024 will be a watershed year for Gen AI. Some believe it is poised to emerge from the shadows of speculation into the spotlight of realization. Others believe its business value is overhyped. Whether Gen AI will fulfill its promises in 2024 is a story yet to be told, but one thing is certain – it will be an exciting year to watch.

Source: www.celent.com